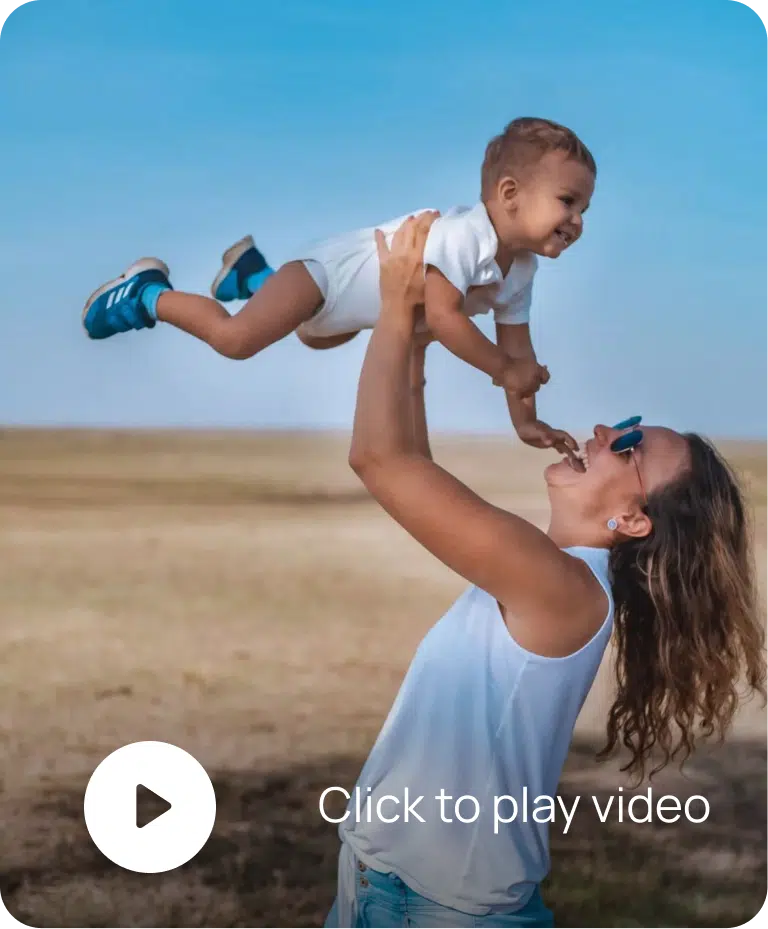

Pick up a camera and

become a full time creator

- Start shooting beautiful videos and photos

- Find your confidence to be in front of the camera

- Get paid to build the business you LOVE

- All while being supported by 5000+ creators

Pick up a camera and

become a full time creator

- Start shooting beautiful videos and photos

- Find your confidence to be in front of the camera

- Get paid to build the business you LOVE

- All while being supported by 5000+ creators

The Struggle is Real...

- Are you drowning in the unpredictable sea of content creation?

- Feeling like you’re being held prisoner by the algorithm?

- Exhausted by the content creation hamster wheel?

- Tired of living pay check to pay check while not getting paid what you deserve?

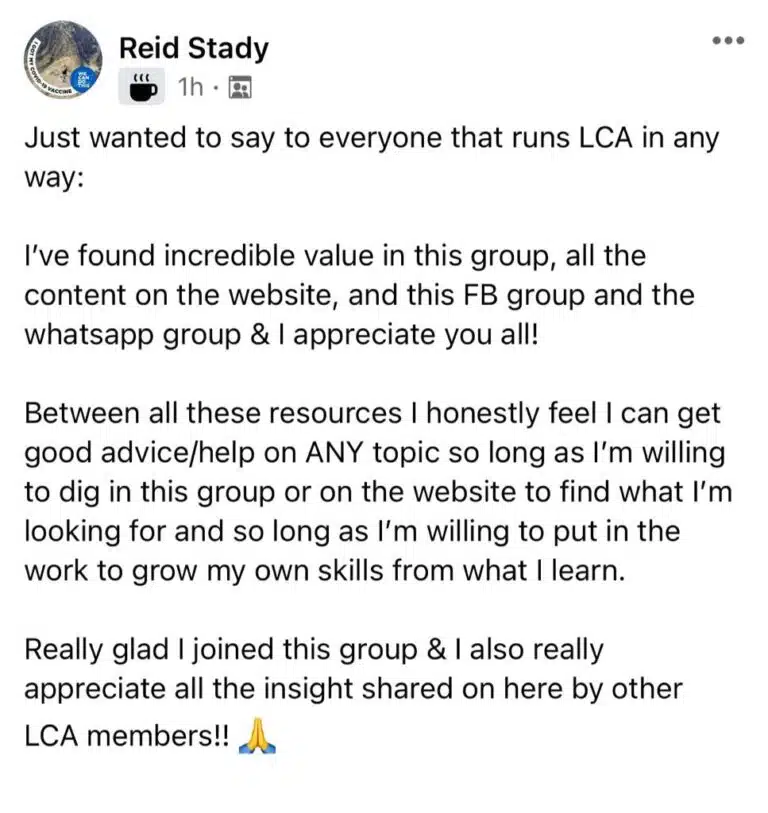

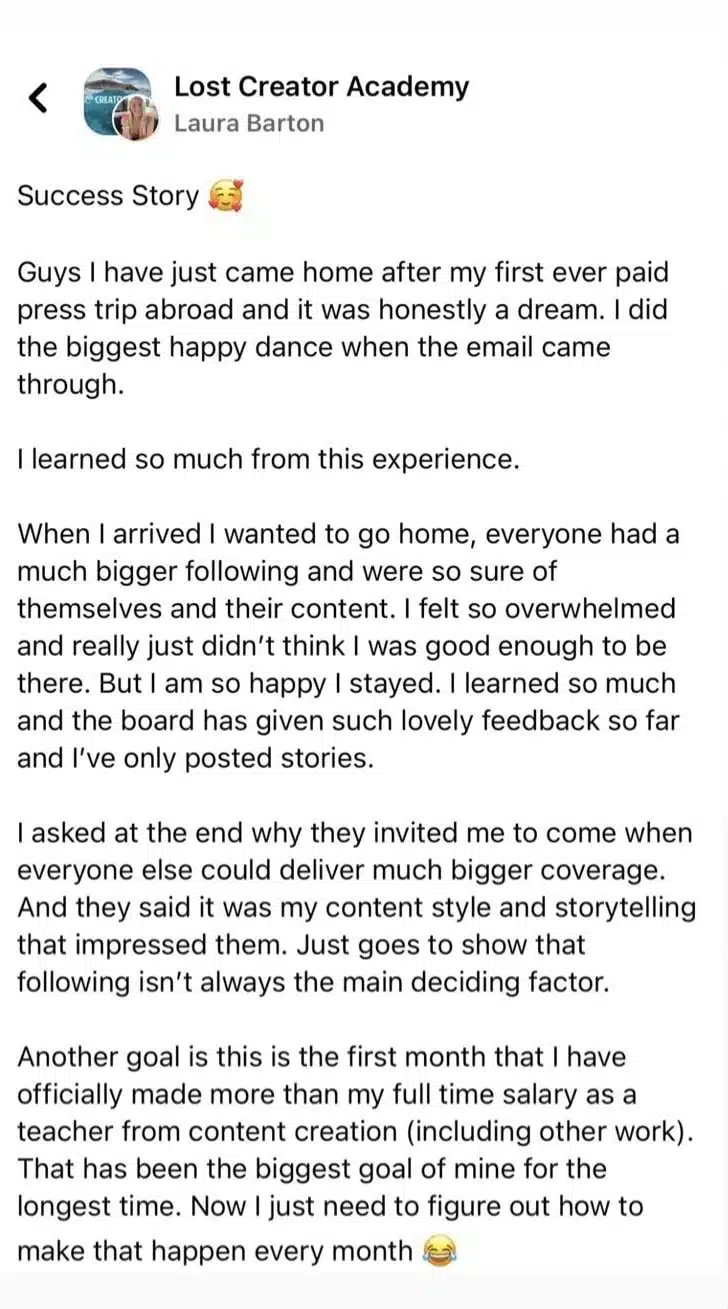

Does LCA Really Work?

Real People -

Real Stories!

Real People - Real Stories!

Mahna - @MahnaGhafori

$0 to $100,000+ in 365 days

100k

Followers

$ 100k

earnings in under 1 year

Emmanuel and Valery - @DosLocosDeViaje

Couch Surfing to Survive to Thriving Creator Empire

Meet Emmanuel and Valery. They went from couch surfing and just barely scraping by financially until they invested in LCA. Today they have an audience of 1.5 million and are getting paid to work with top brands and travel the world (they even landed a yacht deal using the LCA email templates!)

800k

Followers

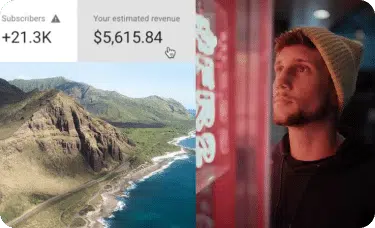

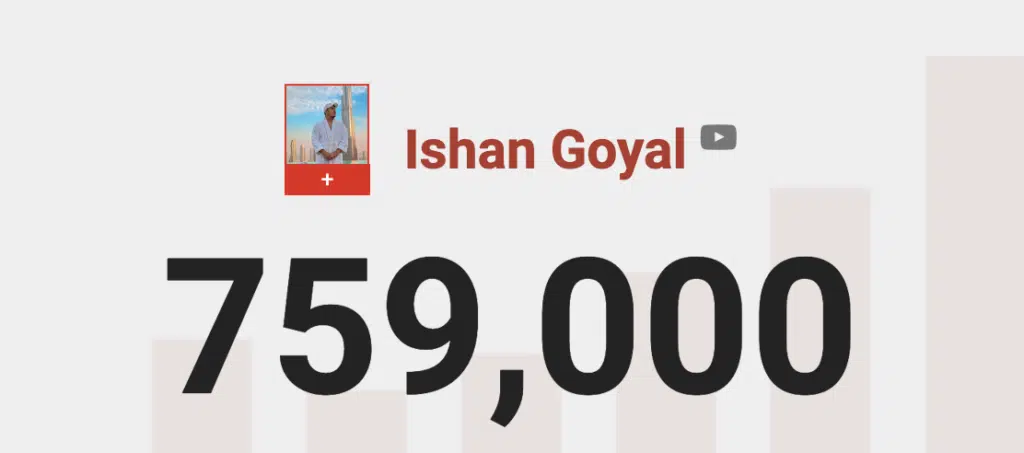

Ishan - @IshanGoyalTravel

Zero to Hero

865k

Followers

Allison Wolf - @WolvesAndWaterfalls

Full-Time Shortform Creator

265k

Followers

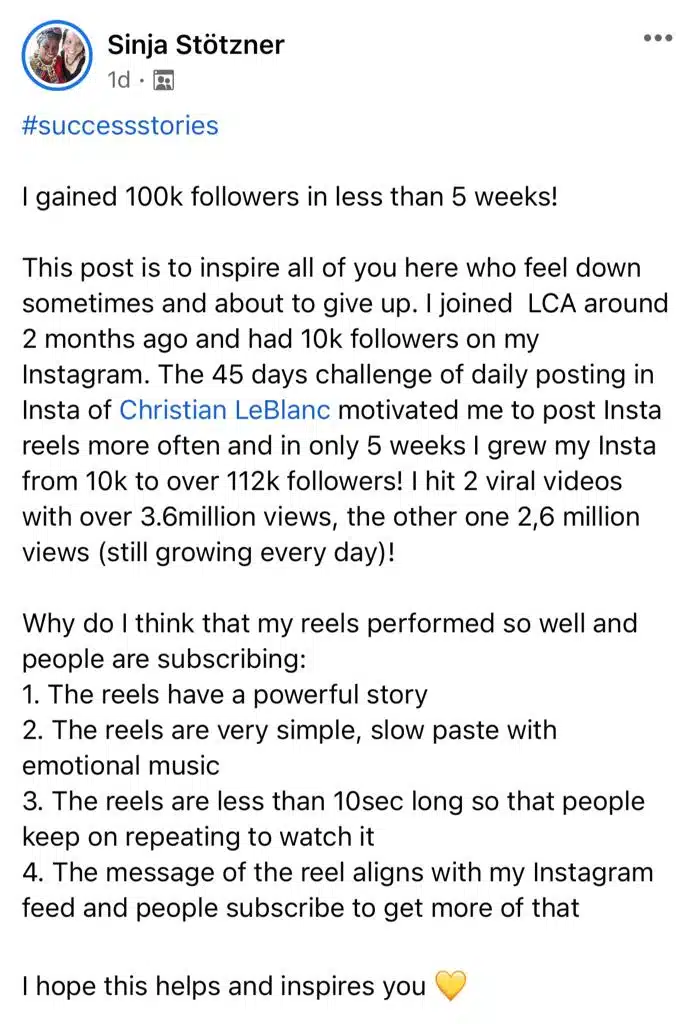

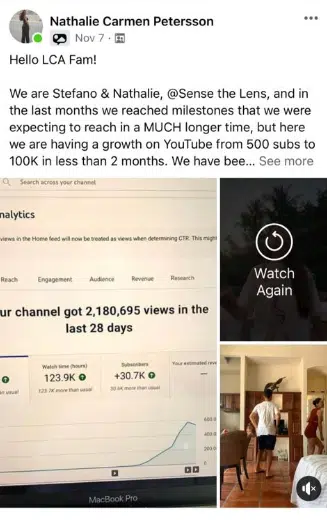

Sinja - @TravelWithSinja

Single Mom Building Her Dream Life

135k

Chris and Marianne @TreadTheGlobeOfficial

Creators come in all ages!

120k

Followers

Mahna - @MahnaGhafori

$0 to $100,000+ in 365 days

Ishan - @IshanGoyalTravel

Zero to Hero

Allison Wolf - @WolvesAndWaterfalls

Full-Time Shortform Creator

Emmanuel and Valery - @DosLocosDeViaje

Couch Surfing to Survive to Thriving Creator Empire

Meet Emmanuel and Valery. They went from couch surfing and just barely scraping by financially until they invested in LCA. Today they have an audience of 1.5 million and are getting paid to work with top brands and travel the world (they even landed a yacht deal using the LCA email templates!)

Sinja - @TravelWithSinja

Single Mom Building Her Dream Life

Chris and Marianne @TreadTheGlobeOfficial

Creators come in all ages!

1 VIDEO CAN CHANGE YOUR LIFE,

WHAT ARE YOU WAITING FOR?

1 VIDEO CAN CHANGE YOUR LIFE,WHAT ARE YOU WAITING FOR?

and get this....

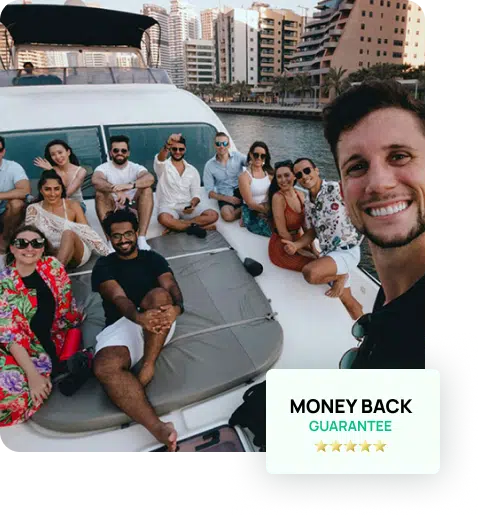

We guarantee your success or money back

Become a FULL-TIME CREATOR - RISK FREE

We are so confident that we can help you replace and OUTPACE your income from your current job using our systems that we even guarantee your investment.

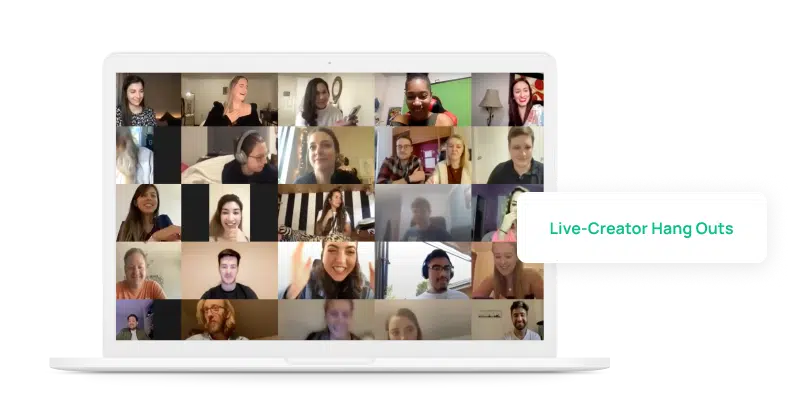

Collaborate & Grow With The Big Creators Of Tomorrow

Collaborate & Grow With The

Big Creators Of Tomorrow

Collaborate & Grow With The Big Creators Of Tomorrow

It’s not fun to create alone.

so...don’t.

See what’s inside

Lost Creator Academy

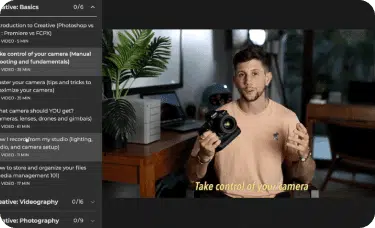

Content Creator Fundamentals

Master your Photography

Master Your Videography

Build a Profitable Business

Grow Your Online Brand

Lessons from Creator Coaches

Content Creator Fundamentals

Master your

Photography

Master Your

Videography

Build a Profitable

Business

I will teach you how to negotiate and land brand deals, how to price yourself, how to get free hotel stays and experiences and how to build multiple income sources as a creator or business…

Grow Your

Online Brand

Lessons from

Creator Coaches

Content Creator Fundamentals

Master your

Photography

Master Your

Videography

Build a Profitable

Business

I will teach you how to negotiate and land brand deals, how to price yourself, how to get free hotel stays and experiences and how to build multiple income sources as a creator or business…

Grow Your

Online Brand

Lessons from

Creator Coaches

From Beginner to Professional

200+ Training Videos

(Over 100 Hours)

LCA gives you ALL the insider tips, tricks and secrets to becoming a successful content creator. Become a pro in the business, and master your creative craft!

Direct Mentorship

Exclusive Creator Community

Share your journey with 5,000+ like-minded creators who will be there to support you through the highs and lows of your journey.

200+ Training Videos

(Over 100 Hours)

LCA gives you ALL the insider tips, tricks and secrets to becoming a successful content creator. Become a pro in the business, and master your creative craft!

Direct Mentorship

Exclusive Creator Community

Share your journey with 5,000+ like-minded creators who will be there to support you through the highs and lows of your journey.

Always Up To Date

Lifetime Access

Always Up To Date

Lifetime Access

The Roadmap

Broke Accountant to

Multi-Million Dollar Creator

Seven years ago, I was an unsatisfied accountant with $2,000 to my name. I quit my 9 to 5 job, opting for a path that radically transformed my life.

Today, I’m a celebrated creator and industry leader with 2.1 million YouTube followers, and 4 million in total across platforms. I turned my love for storytelling into a multi-seven figure business with 8 income streams. I’ve partnered with top-tier brands, tourism entities, and global five-star hotels.

Brands I’ve Worked With

Stay at Our Exclusive Creator House in Bali

Meet Your LCA Teachers

Apply To Join The Lost Creator Community Today

Book A Free Call

- Unlimited access to over 200 Videos

- Join Meet-Ups & Travel With Us

- Get Top Creator Tips and Strategies

- Exclusive group chats, calls & channels

- Strategy Calls with your Success Coaches

FAQs

No, this is a common misconception. LCA shows you how to create AMAZING travel content but these lessons are 100% relevant no matter what genre or category of content you create. If you are a personal trainer, a beauty vlogger, a food blogger or really anyone that wants to grow your online presence and elevate your brand with beautiful content, then LCA is for you!

You get direct access to ME and my team within the private community. Got a question about a new lens you’re considering buying? Ask us. Having a hard time finding paying clients? Let’s chat strategy and tactics. Want feedback on a recent video? I’d love to review it and share my thoughts and feedback.

YES. It’s that simple. Buy once, learn and grow with myself and the community for life.

LCA now has over 5,000 members and each and every one of them has raved of the insane amount of value they got for their investment. And because the academy’s content grows daily, your investment only becomes more worthwhile by the day. When you land your first paying client because of LCA and break the many months of slow social growth, this will become the best investment you’ve ever made.

“LCA is worth every dollar! I love the community and I am already seeing progress in my work” @Sarah_Sittezoellner.

If you go on to practice the business and creative skills taught in LCA, you will be ready to start earning thousands of dollars as a freelance videographer and photographer from ANYWHERE.

Dozens of LCA members have said that their favourite thing about LCA is the community group. It has enabled members from around the world to collaborate, plan trips together, and support one another in growing their businesses. It has enabled members to be able to share this unique journey with likeminded individuals who they would not have been able to find otherwise. In addition to community, this is where you can ask your questions, get feedback on your work, and join in on the countless Creator Challenges we host in the exclusive community group!

ANYONE can enter LCA and with time and practice become a true professional. It’s built for any skill level!

If you have a head start, then that is fantastic because we have a ton of high-level editing tutorials, business mastery and creator challenges that will take your current skills and push them to improve. LCA is built for any skill level!

This is my new full-time job. Content will continue to grow for many years to come and there is no end in sight.

Due to the academy being an online course, good internet connection will ensure for great video playback.

You can start today without any software by focusing on the business modules and even some of the creative basics but when it’s time to dive into editing, you will need a way to edit. You can certainly start with free editing software for mobile phones and computers however I recommend you get started with Adobe’s creative suite (Photoshop, Lightroom, Premiere Pro) or FinalCut Pro X.

No! It is unrealistic to immediately drop all your responsibilities to chase your dreams BUT that is why I will teach you how to build the skills as quickly as possible until you are ready to make the jump into being a full-time content creator.